45l tax credit requirements

For each manufactured home that meets the 30 energy efficient standard the allowable credit is 1000. 179D commercial property energy efficiency tax deduction that I posted about.

45l Tax Credit Overview And Analysis Of The Residential Efficiency Energy

It is soldleased initial lease to a person for use as a residence.

. The 45L Tax Credit originally made effective on 112006 offers 2000 per dwelling unit to developments with energy consumption levels significantly less than certain national energy standards. 45L Tax Credit Requirements. Meets the requirements of paragraph 1 applied by substituting 30 percent for 50 percent both places it appears therein and by substituting ⅓ for ⅕ in subparagraph B thereof or.

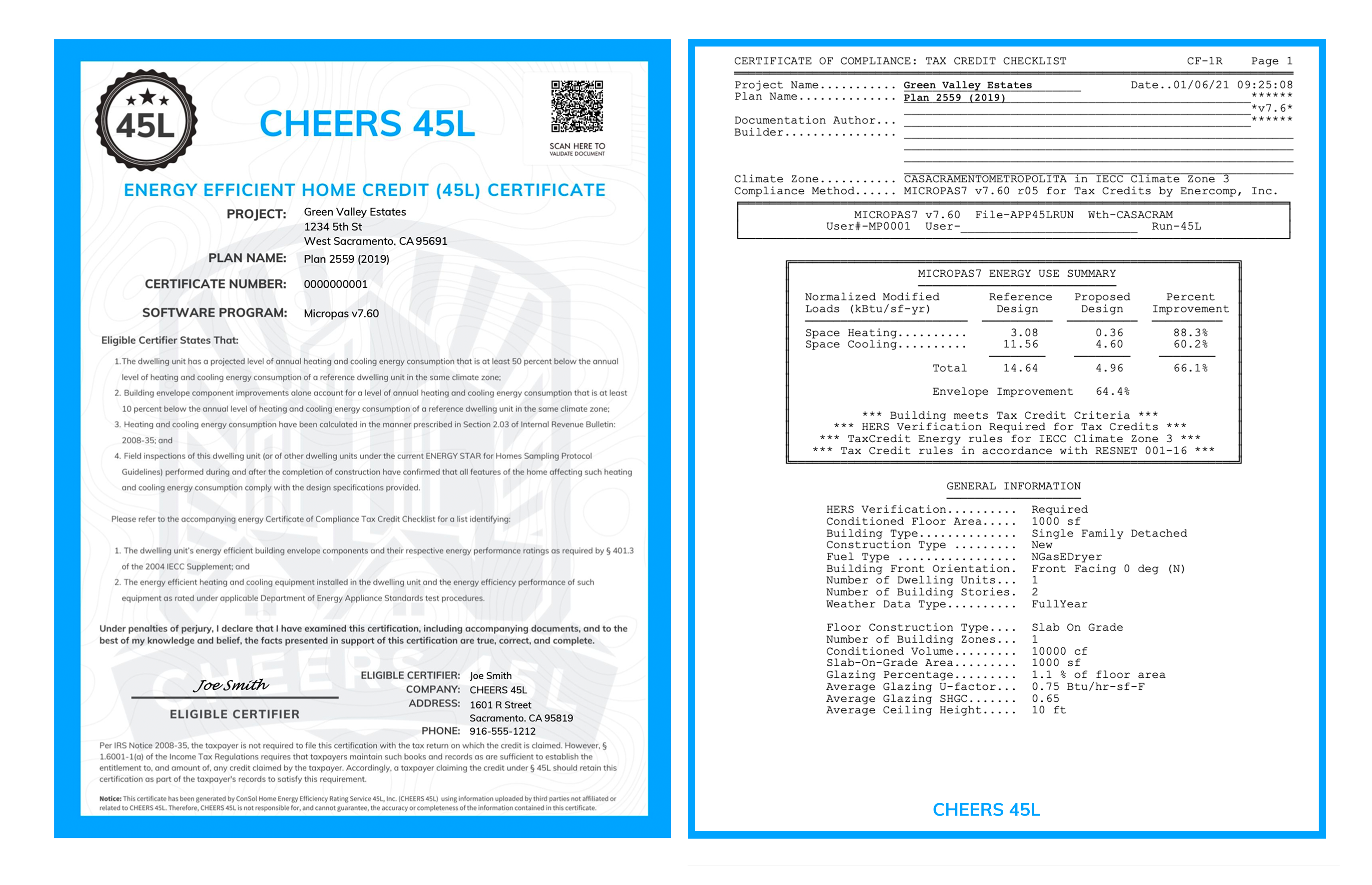

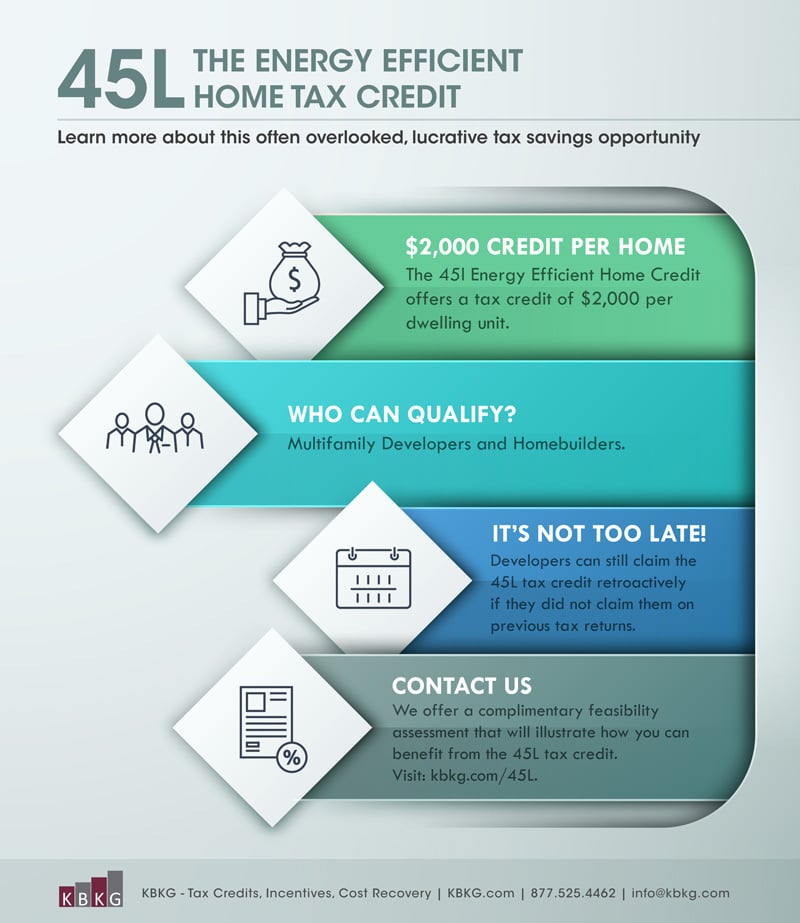

Homes and apartments must be at least 50 above the 2006 International Energy Conservation Code IECC. There is also a credit for manufactured homes that meet a lesser energy-saving requirement. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

This must be done by an unrelated licensed professional. In this project 100 percent of the units qualified for the credit. 45L Energy Efficient Dwelling Unit Tax Credits If you develop build or own energy efficient residential dwelling units you could earn tax credits of 2000 per unit.

Reduce the expenses incurred in the construction of each new home by the amount of the credit. Tax credit 2000 x 83 units - 166000. The efficiency requirements remain unchanged from the original tax credit program.

Home energy features HVAC insulation etc must be verified by a qualified Rater 45L Eligible Certifier. Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

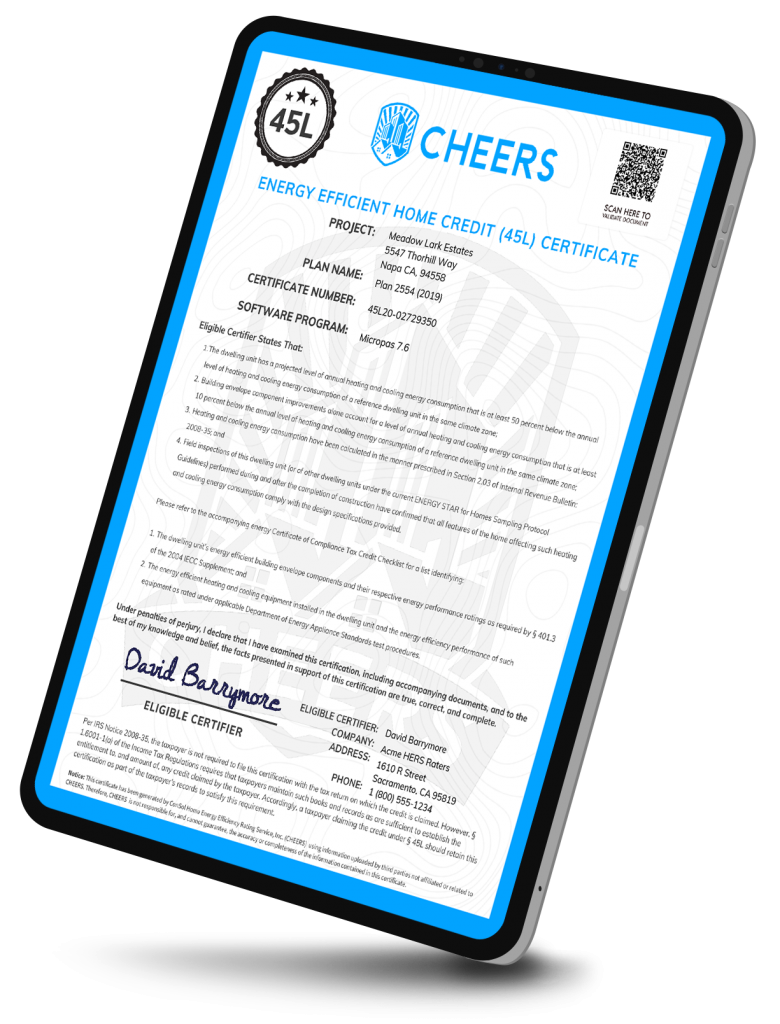

The 45L tax credit is available to an eligible contractor in the year the certified dwelling units are leased or sold. In order to claim the 45L tax incentive taxpayers need to complete a 45L tax credit certification for each project. 133 signed into law by President Trump on December 27th extended the 45L energy efficient home 2000 tax credit which had been scheduled to expire last year to cover qualified new energy efficient homes sold or leased through 2021.

IRS Form 8908 is used to claim the 45L tax credit. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home. That credit is 1000 per unit.

The 45L credit not only includes new construction but reconstruction and rehabilitation projects. One valuable but an under-utilized tax credit for home builders and contractors was Section 45L. For instance if the taxpayer hires a third-party contractor to build or upgrade a dwelling unit that taxpayer is the eligible contractor and.

Code 45L - New energy efficient home credit. For qualified new energy efficient homes other than manufactured homes the amount of the credit is 2000. 45L provides a 2000 credit for a traditional free-standing home and either a 1000 or 2000 credit for a manufactured home depending on the level of energy savings achieved.

To claim the 45L tax credit taxpayers must have a 45L Tax Credit Certification completed for each project by an unrelated licensed professionalAn engineer familiar with 45L certifications can help evaluate a development project and provide a 45L certification and related documentation to aid in claiming the 45L tax credit. The 45L Energy-Efficient Home Tax Credit is equal to 2000 per residential unit or dwelling to the developers of energy-efficient buildings. The credit was extended by the Consolidated Appropriations Act 2021 and applies to residences sold or leased on or before December 31 2021.

Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. What are the energy efficiency requirements for the 45L tax credit. As part of the New Energy Efficient Home Tax Credit under Code Section 45L a 1000 credit is also available for an eligible contractor with respect to a manufactured home.

Qualifying properties include apartments condominiums townhouses and single family homes. Section 45L requirements for a new energy-efficient home Before a property can be evaluated in terms of its energy efficiency it must meet certain requirements to be eligible for the credit. For a dwelling unit to qualify for the 45L credit it must show a reduction of energy use by at least 50 percent when compared to the applicable standards in chapter 4 of the 2006 International Energy Conservation Code.

An engineer knowledgeable with 45L certifications can help in evaluating a development project and grant 45L certification and related records to help claim the tax credit. The credit is typically not available a person eventually residing in the home. Most consider this code the Go Green Tax Credit as it promotes energy saving construction and rehabilitation of older properties.

The Consolidated Appropriations Act 2021 HR. With todays more stringent IECC 2018 code in effect most current construction will qualify. The incentive applies to single-family homes as well as condominiums apartment complexes and other multifamily residential buildings whereby each unit may qualify for a 2000 credit.

The manufactured home must have a projected level of annual heating and cooling energy consumption that is at least 30 below the annual level of heating and cooling energy. Raters must use energy modeling software such as EnergyPro which complies with the tax credit software. It provided a tax credit of up to 2000 per residential dwelling unit when certain energy efficiency standards were met.

To qualify as the eligible contractor the taxpayer must own the property and have basis in the qualified energy efficient dwelling unit. The 45L credit can have substantial value as demonstrated by these case studies. Homes must be 50 more efficient on heating cooling and hot water use than the IECC 2006 standards.

2000 per unit for new energy-efficient home. Made up of one or more rooms including a kitchen. These valuable credits are overlooked due to a lack of understanding about the qualification process.

Each unit must be. A nice caveat is that even. At least one-fifth of the 50 percent energy efficiency must come from improved building envelope components.

Section 45L was in effect from 2006 through 2021. Project certification fee 400 x 83 units - 33200. The maximum credits per dwelling unit are.

Single family homebuilders and multifamily developers can benefit from the 45L Tax Credit. To qualify for the 2000 tax credit eligible dwelling units must be certified to meet or exceed the required energy efficiency benchmarks and then sold or leased no later than December 31 2021. A dwelling unit qualifies for the credit if--.

The credit is typically not available a person eventually residing in the home. The 45L tax credit first went into effect on January 1st 2006 for homes built after August 8th 2005. Located in the United States.

Though it recently expired residential developers and contractors can still. IRS Form 8908 is used to claim the 45L tax credit. Three-story 83-unit multi-family project fully leased in the eligible year.

45l Tax Credit Services Using Doe Approved Software

Contractors Securing Work With The 45l Tax Credit Aeroseal

Dpis Builder Services 45l Energy Efficiency Tax Credit

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

What Is The 45l Tax Credit Get 2k Per Dwelling Unit We Can Help

How Does The 45l Tax Credit Work Energy Diagnostic

45l The Energy Efficient Home Credit Extended Through 2017

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

Taxes Paparazzi Business This Post Is Intended To Help You Be Organized This Year And H Paparazzi Jewelry Images Paparazzi Jewelry Paparazzi Jewelry Displays

Green Building That Saves You Big Bucks With 45l Tax Credit Benefits Income Tax Tax Preparation Tax Deductions

45l Tax Credit Still A Great Way To Save For Property Investors Developers And Owners Debt Relief Programs Tax Debt Debt Relief

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

The 45l Tax Credit Is Expiring Again Cheers 45l

45l Tax Credit Energy Efficient Tax Credit 45l

One Year Extension Through 2021 For Energy Efficient Home Section 45l Tax Credit Warner Robinson Llc